Leverage, margin and lots

Leverage — Your trading power-up

Ever wish you could trade big without spending a huge pile of cash? That’s what leverage is for! With leverage, you can control bigger trades with a smaller amount of your own money. It’s like borrowing extra money from your broker to boost your trading power.

🚀 Ready to see why leverage rocks? Let’s dive in!

Leverage, margin and lots

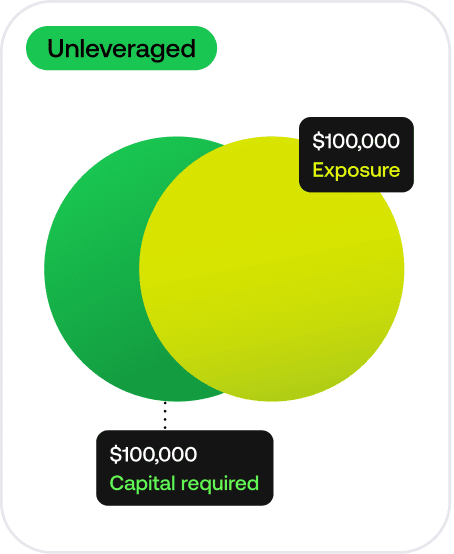

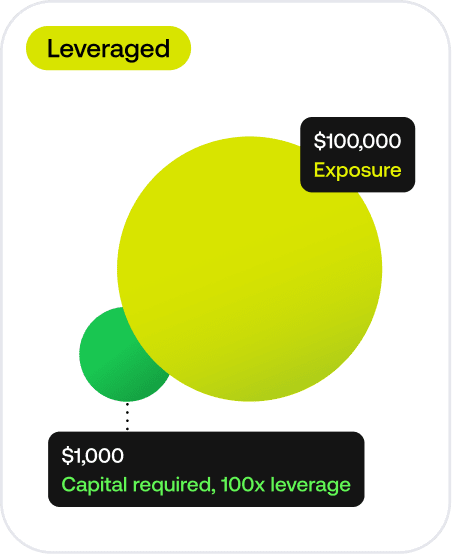

How leverage works

Let’s say you want to trade on Bitcoin. Without leverage, you’d need $100,000 to buy 1 BTC. But with 100x leverage, you only need $1,000 (1/100th of the full price).

Now, if Bitcoin rises to $105,000, that’s a $5,000 profit. The best part? That $5,000 is yours even though you only put in $1,000! Without leverage, you’d need the full $100,000 to make the same profit.

⚠️ Be careful: Leverage works both ways. If the market goes against you, your losses also increase at the same scale.

Leverage, margin and lots

Margin — Your entry ticket

To trade with leverage, you need to put down a small portion of your own money as margin — think of it as your security deposit. The broker holds this to cover any potential losses.

The higher the leverage, the smaller the margin needed. So, with 100x leverage, you’d need less margin than with 50x leverage.

Leverage, margin and lots

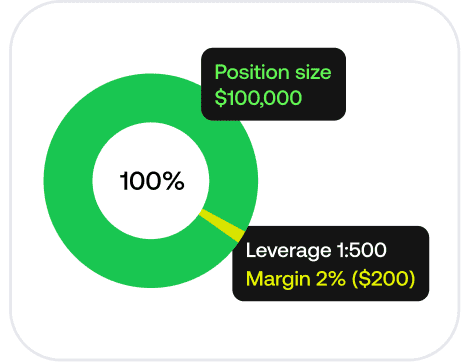

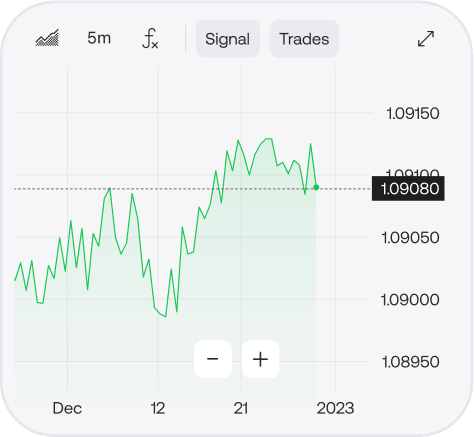

Leverage on Doto: Choose your power

On Doto, you can choose your leverage! Go big with up to 500x leverage on currency pairs, or stay cautious with lower leverage on stocks.

Here’s the max leverage per market:

- Forex: 500x

- Indices: 200x

- Commodities: 100x

- Crypto: 50x (100x for Bitcoin)

- Stocks: 20x

Want to tweak your leverage? Just hop into your account settings and adjust it anytime.

Leverage, margin and lots

Trade size options: Margin vs. lots

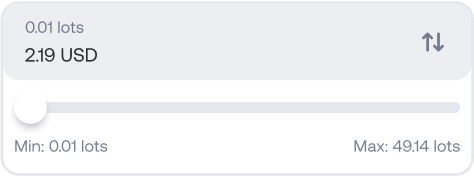

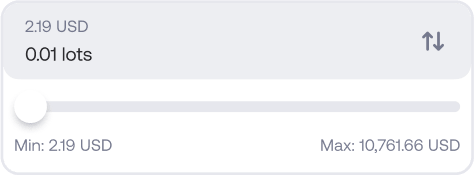

When deciding on your trade size, you’ve got two options: margin or lots.

💵 Margin is like saying, “I’ve got this amount of money — how much can I trade with it?”

⚖️ Lots are more like, “I want to trade this quantity — how much will it cost me?”

The bigger the margin or lot size, the bigger the impact of price movements on your trade result. That means higher potential gains, but also higher risks. So choose wisely!

Leverage, margin and lots

What is a lot?

A lot is just a standard unit for measuring how much you’re trading. Here’s how it breaks down:

- Bitcoin, Ethereum: 1 lot = 1 coin

- Gold: 1 lot = 100 ounces

- EURUSD: 1 lot = 100,000 currency units

- NVIDIA: 1 lot = 100 shares

- S&P 500: 1 lot = 10 units

If you’re just starting out, don’t worry — Doto lets you trade on as little as 0.1 lot to test the waters.

💡 A quick tip: If lots feel confusing, you can always stick with margin to keep things simple.

Leverage, margin and lots

Tips for choosing your trade size

📝 Choose your risk level: Decide on how much of your funds you’re comfortable with risking. A common approach is around 5% of your account balance per trade. For example, if you deposit $1,000, you’d risk approximately $50 per trade — a balanced way to manage potential losses while staying active in the market.

📝 Always use a stop loss: This tool automatically closes your trade if the market moves against you, limiting your losses (don’t worry, we’ll show you how soon!)

Leverage, margin and lots

Quick quiz: Test your knowledge

If you trade with 500x leverage, your margin (reserved funds) will be:

Leverage, margin and lots

Summing up

Congrats, you made it through! Now you know:

- What leverage is and how it works

- The role of margin and lots

- How to choose your trade size

Next, we’ll dive into making smart trading decisions. Doto has plenty of tools to help you trade like a pro, and we’ll cover them in the next lesson. Stay tuned!