-

Fundamental analysis

Turn news into opportunities

💹 Economic news, interest rates, job reports — you can capitalize on these market-moving events and more. The key? Fundamental analysis.

Instead of focusing on charts and patterns like with technical analysis, fundamental analysis helps you forecast price changes by understanding the real-world factors driving the market. Let’s dive into it!

-

Fundamental analysis

Macroeconomic indicators

Macroeconomic reports tell you how healthy a country’s economy is — and they can really move forex markets! Here are the key reports to watch.

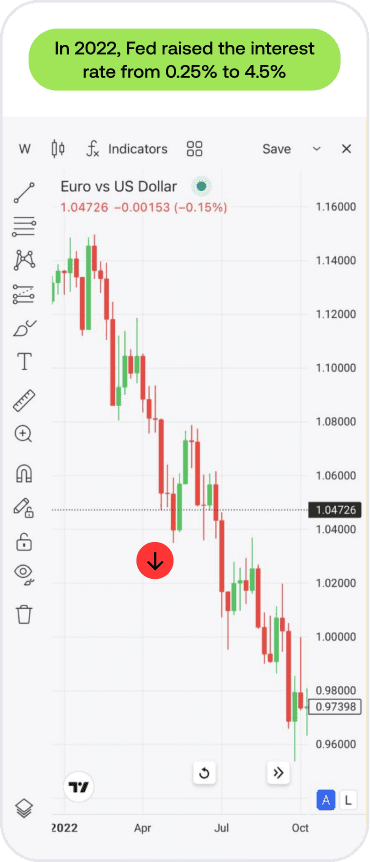

Interest rate decisions by central banks (Fed, ECB, BoE, etc.)

🔼 Higher rates → Investors attracted → Currency strengthens

🔽 Lower rates → Cheaper loans → Currency weakens

🟰 No change? The market moves instead based on expectations and central bank speeches

💫 Example: The USD rose in 2022 after the Fed raised the interest rate.

-

Fundamental analysis

GDP reports

💪 Strong GDP → Healthy economy → Currency strengthens

💔 Weak GDP → Economic slowdown → Currency weakens

Inflation data (CPI and PPI reports)

🔼 High inflation → Central bank may raise interest rate → Currency strengthens

🔽 Low inflation → Interest rate may stay low → Currency weakens

-

Fundamental analysis

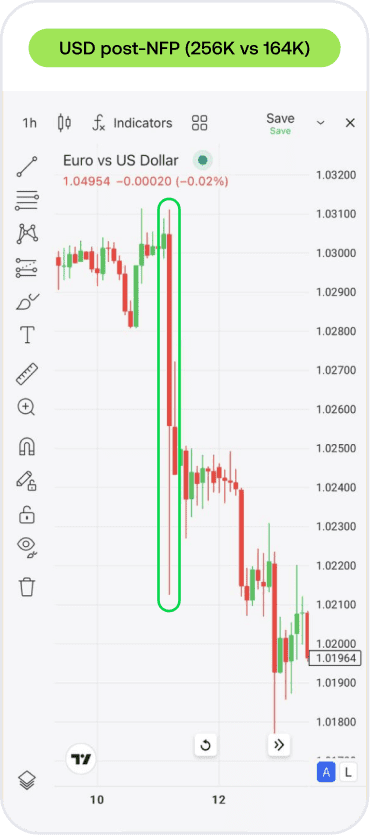

Employment reports (e.g., nonfarm payrolls)

👨🔧 More jobs → Economic growth → Currency strengthens

📊 High unemployment → Economic slowdown → Currency weakens

💫 Example: After nonfarm payrolls greatly outperformed the forecasts in January 2025 with 256K vs. 164K jobs expected, USD strengthened.

-

Fundamental analysis

Microeconomic indicators

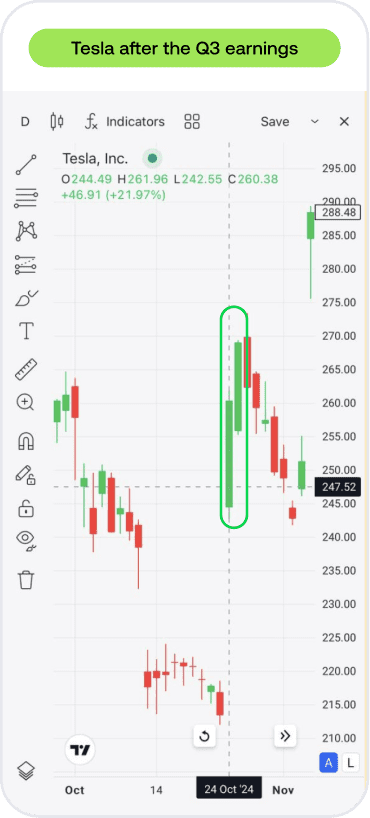

For stocks, focus on the company’s performance and financial health. Look for these key indicators:

📊 Revenue and sales growth (reflects the company’s success)

📊 Earnings per share or EPS (compares the company’s profitability)

💫 Example: Tesla’s Q3 earnings beat the forecasts, causing the stock to jump 17% after hours!

-

Fundamental analysis

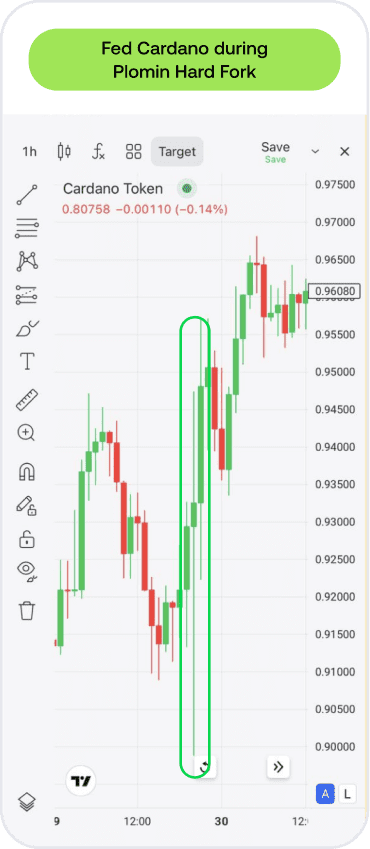

Crypto-specific factors

Crypto markets have unique factors, so here’s what you should watch out for.

- Regulation. Government bans or new regulations can cause massive price swings

💫 Example: China’s crypto ban in 2021 caused Bitcoin’s price to drop 40% in two weeks.

- Network upgrades and hard forks. Major updates can affect prices by improving scalability and reducing energy consumption

💫 Example: Cardano became very volatile on the day of the Plomin Hard Fork on January 29, 2025

- Adoption and institutional support. If major companies or governments adopt crypto, prices tend to rise

💫 Example: Bitcoin strengthened after the US Presidential election in 2024 and Trump's pro-crypto agenda

-

Fundamental analysis

How to use fundamental analysis

There are two main strategies for using fundamental analysis in your trades.

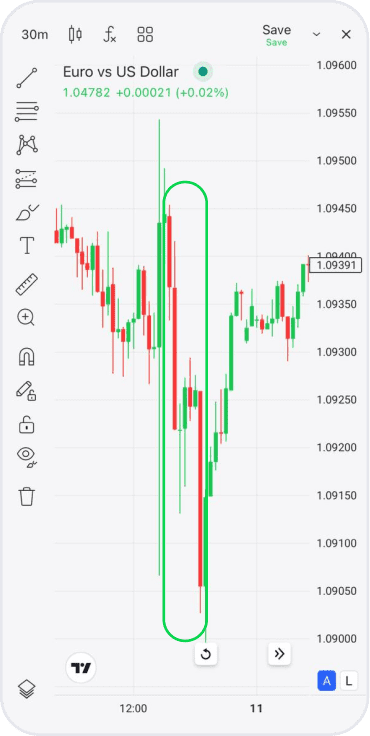

1 Stay away during big events

The market can go crazy after big releases, so some traders prefer waiting until things calm down.

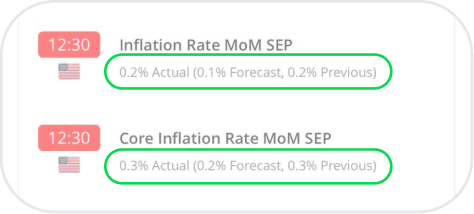

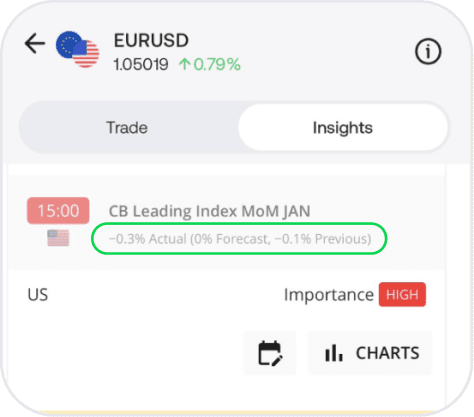

2 Trade on the news in real time

If you want to trade on economic events and catch price swings, the golden rule is to compare the analyst forecasts with actual results to make more informed decisions.

🔼 Better than expected? The instrument will likely rise

🔽 Worse than expected? The instrument will likely fall

Be careful — wild price swings can trigger your stop losses!

-

Fundamental analysis

Quick quiz: Test your knowledge

How does high inflation typically affect interest rates?

-

Fundamental analysis

Summing up

Great job! In this lesson, you’ve learned:

- The difference between technical and fundamental analysis

- How interest rates, GDP, inflation and employment reports impact prices

- How crypto-specific events like regulations and upgrades drive the market