Trading basics

From zero to trading hero

Trading is all about making money from price changes in things like crypto, stocks, currencies and more. The idea is simple: buy low, sell high.

🌟 Amazing fact: If a trader had placed a $100 up trade on Bitcoin with 100x leverage on Jan. 1, 2024 and closed it a year later, the potential profit would have been over $5,390!

That’s the power of CFD trading. Ready to dive in? Let’s go!

Trading basics

What is CFD trading?

CFD stands for “contract for difference.” You don’t actually own the instrument — you just make a contract with a broker (like Doto) about where you think the price will go.

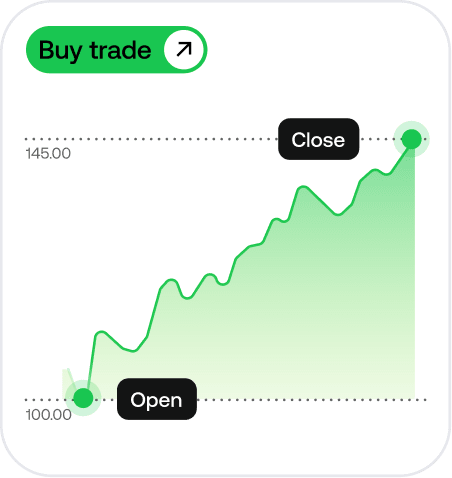

Think the price will rise? You open a buy trade

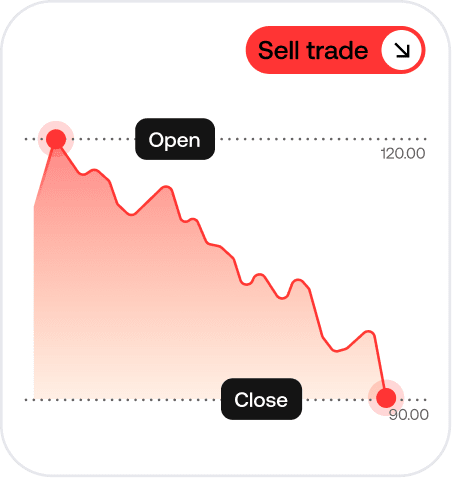

Think the price will rise? You open a buy trade Think it’ll drop? You open a sell trade

Think it’ll drop? You open a sell trade

If your prediction is correct, you pocket the difference in price. The best part? You can capitalize on both rising and falling markets!

Trading basics

A broker — Your gateway to the market

You can’t trade directly on the market without a broker. They handle all the technical stuff behind the scenes, like connecting you to global exchanges and making sure your trades run smoothly.

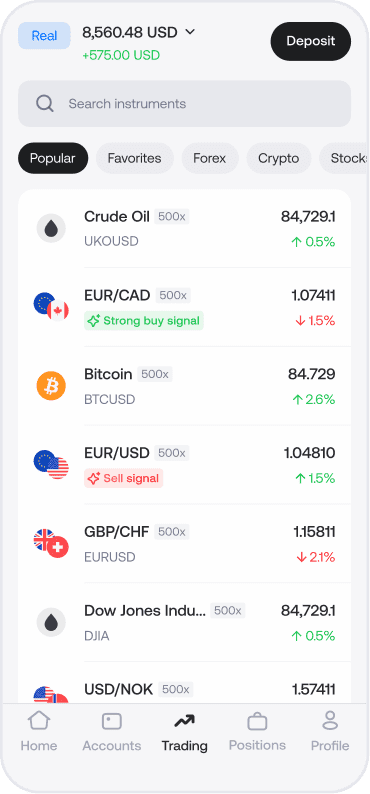

💫 At Doto, we do more than just execute trades — we provide insights and tips to help you make smarter decisions on 1,000+ financial instruments!

Trading basics

What can you trade?

On Doto, you can trade a wide range of instruments:

- Cryptocurrencies: Bitcoin, Ethereum and other digital currencies

- Forex: Currency pairs like EURUSD and GBPJPY

- Stocks: Shares of companies like NVIDIA, Tesla, Apple and more

- Commodities: Gold, silver, oil and other natural resources

- Indices: Major stock indices like the S&P 500 or Nasdaq

Trading basics

How to read instrument names

📉 Forex, crypto and commodities are usually shown as pairs or symbols:

Forex: EURUSD, GBPJPY — the first currency (base) is valued against the second (quote)

Crypto: BTCUSD, ETHBTC — similar to forex, these show how much one asset is worth in another

Commodities: XAUUSD (gold), UKOUSD (Brent oil) — measured against the listed currency

📈 Stocks and indices are expressed in tickers:

Stocks: AAPL (Apple), TSLA (Tesla) — each company has its own unique abbreviation

Indices: S&P 500 (US500), Nasdaq 100 (US100) — these represent a group of stocks, showing market performance

Trading basics

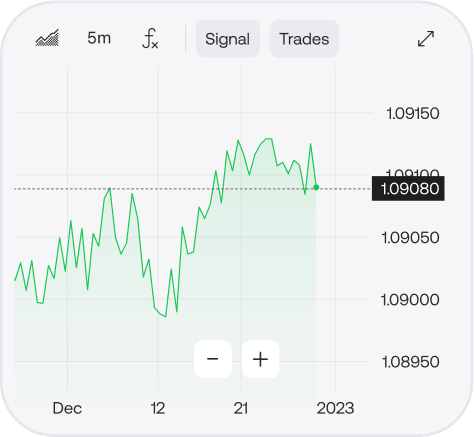

Trading terminal: Your control center

This is your trading terminal. Let's break it down:

- Instrument name, price and 24-hour change: See the basics at a glance

- Chart: The main tool for tracking price movements

- Trade buttons: Wondering why there are two prices here? Press Next to find out!

- Instrument name, price and 24-hour change: See the basics at a glance

Trading basics

Bid, ask and spread

Every instrument has two prices, kinda like a currency exchange at a bank. Here’s the deal.

- Bid (sell price): The price buyers are willing to pay (you sell at this price)

- Ask (buy price): The price sellers want (you buy at this price)

The difference between these two is called the spread — this is the fee for processing your trade. That’s how brokers make money.

Spreads are measured in pips, which brings us to the next topic.

Trading basics

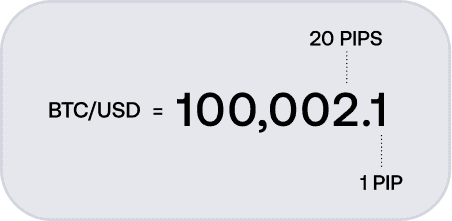

What is a pip?

A pip is the smallest unit of change in a price.

For most currency pairs, a pip is the fourth number after the decimal.

📏 Example: If EURUSD moves from 1.1000 to 1.1001, that’s a change of 1 pip.

For other instruments, like gold, indices and some cryptocurrencies, a pip is the first number after the decimal.

📏 Example: If BTCUSD moves from 100,000.1 to 100,000.2, that’s a change of 1 pip.

Now you know the basics of trading! So, let’s start practicing on a demo account.

Trading basics

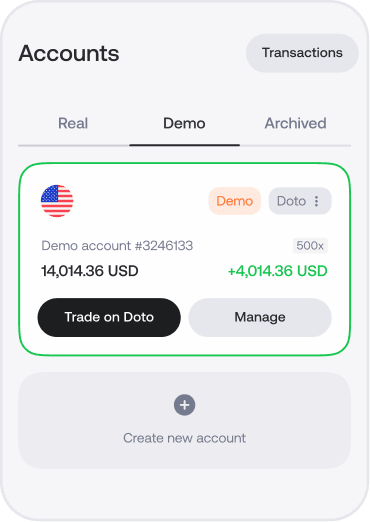

Demo account: Your safe space

Why start with a demo account? Simple:

- Zero risk. Trade with virtual money and no stress

- Real market conditions. Watch live price action in real time

- Hands-on practice. Get comfy with the platform and tools

- Confidence boost. Test strategies, make mistakes and learn without losing a cent

Trading basics

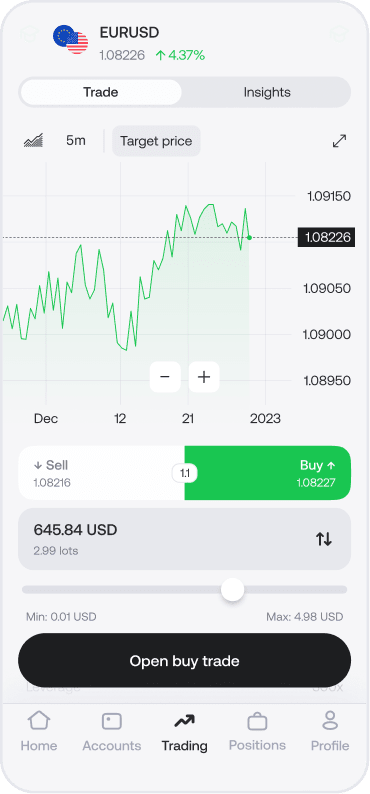

Let’s open a demo trade

Simply follow these steps:

- Pick any instrument you like

- Forecast its price direction and press Buy or Sell

- Press Open trade

Boom — you just made a trade!

📍 Spoiler: Doto also offers trading signals to help you forecast market moves more accurately. More on that soon!

Trading basics

Quick quiz: Test your knowledge

Imagine you’re trading on USDJPY, and the price starts falling. What does that mean?

Trading basics

Summing up

Congrats! You finished the first lesson. Now you know:

- What CFD trading is

- What instruments you can trade

- What bid, ask, spread and pips are

- How to start trading with a demo account

Next up, we’ll explore why you don’t need a big budget to start trading — it’s all thanks to leverage. Ready? Let’s go!