-

Managing risks

Managing risks: Protect your trades like a pro

Ever wished you could lock in your profits before the market flips? Or stop a loss in its tracks before it gets worse? Now you can!

🛡️ With stop loss (SL) and take profit (TP), you can make the most out of your trades while keeping your risks in check. Let’s break them down!

-

Managing risks

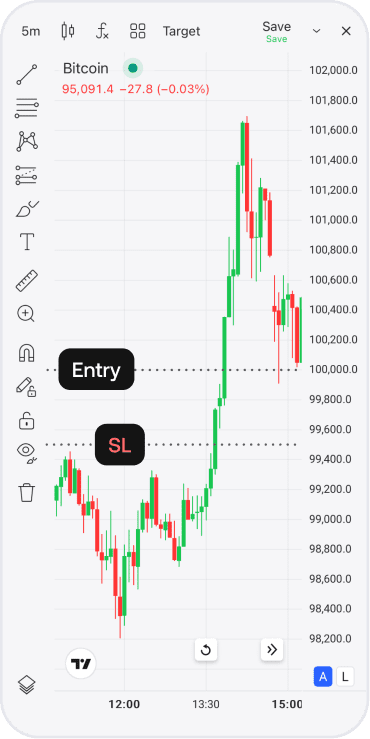

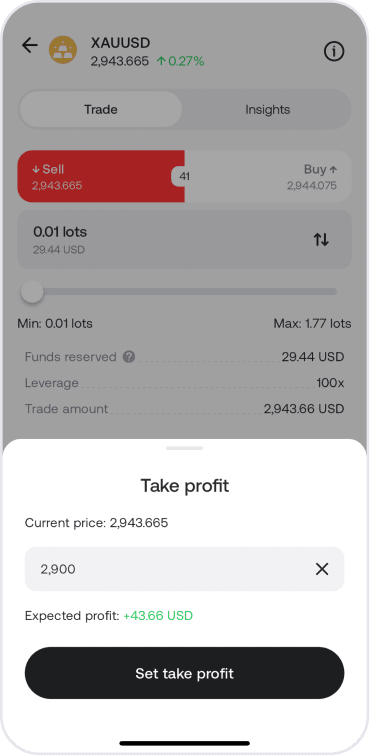

Stop loss: Limit your losses

Stop loss automatically closes your trade when the price reaches your risk limit, helping you avoid big losses. It’s like saying, “If the price drops to this level, I’m out before it gets worse.”

🟢 Buy trade? Set the SL below the current price

🔴 Sell trade? Set the SL above the current price

💰 Example: You buy Bitcoin at $100,000 and set the SL at $99,500. If the price drops to $99,500, your trade closes automatically, preventing further losses. No need to watch the screen all day!

-

Managing risks

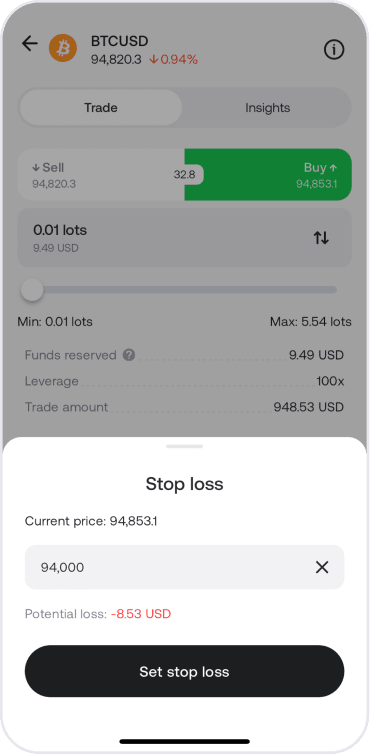

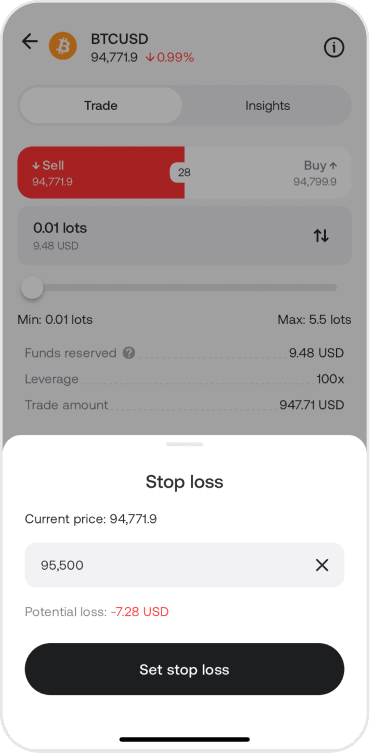

How to set a stop loss

- Pick any instrument you like

- Turn on stop loss (Doto suggests a 5% SL, but you can adjust it)

- Open a trade in the trend’s direction

- Leave the rest to us! Your trade will close automatically

Got a trade open already? You can add or adjust the SL whenever you want in the Positions tab.

-

Managing risks

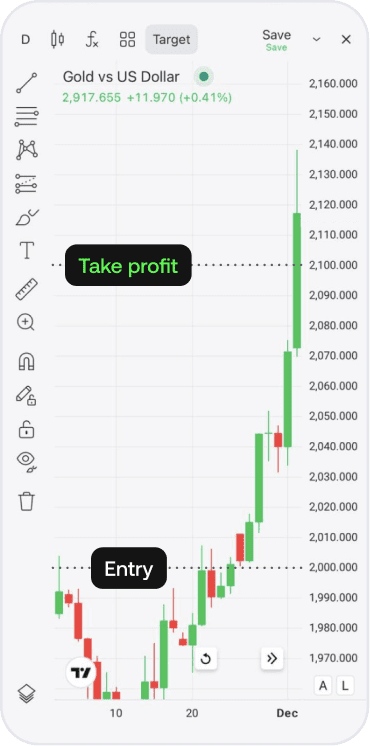

Take profit: Secure your gains

Take profit automatically closes your trade when the price hits your target, locking in your profits. It’s like saying, “I’ve made enough money — time to cash out!”

🟢 Buy trade? Set the TP above the current price

🔴 Sell trade? Set the TP below the current price

💰 Example: You buy gold at $2,000 and set the TP at $2,100. If the price reaches $2,100, your trade closes automatically and you keep the profit without having to watch the market all day!

-

Managing risks

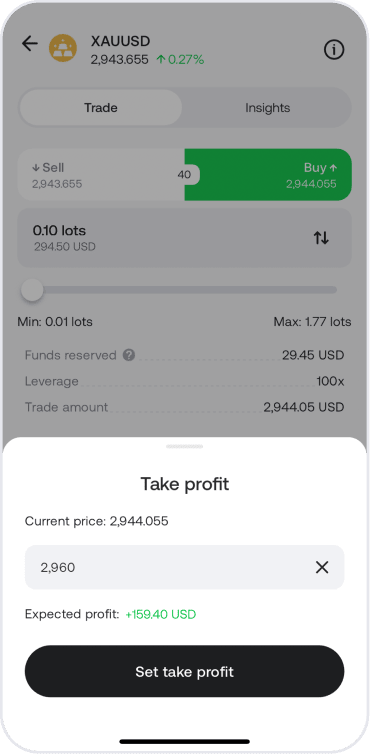

How to set a take profit

- Pick any instrument you like

- Turn on take profit (Doto suggests a 10% TP, but you can adjust it)

- Open a trade in the trend’s direction

- Leave the rest to us! Your trade will close automatically

📈 Got a trade open already? You can add a TP whenever you want by going to the Positions tab and updating your trade settings.

-

Managing risks

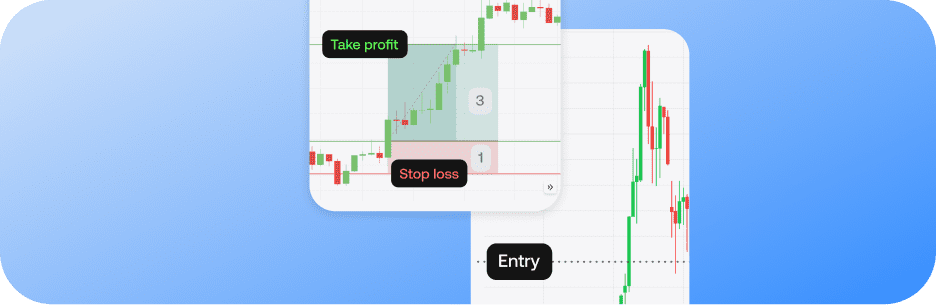

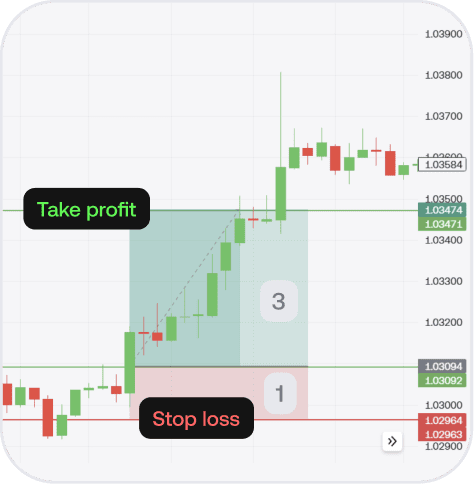

Quick tips for smarter risk management

- Be realistic. Don’t set the SL or TP too close to your trade’s open price, nor too far. Unrealistic targets might trigger too fast or miss their chance to close

- Use a risk-reward ratio. The most common strategy is a ratio of 1:3 (risk $1 to potentially make $3). This way, even if you lose some trades, you stay profitable overall

- Stay flexible. If the market moves in your favor, adjust your TP to lock in more profit or tighten your SL to protect your gains

-

Managing risks

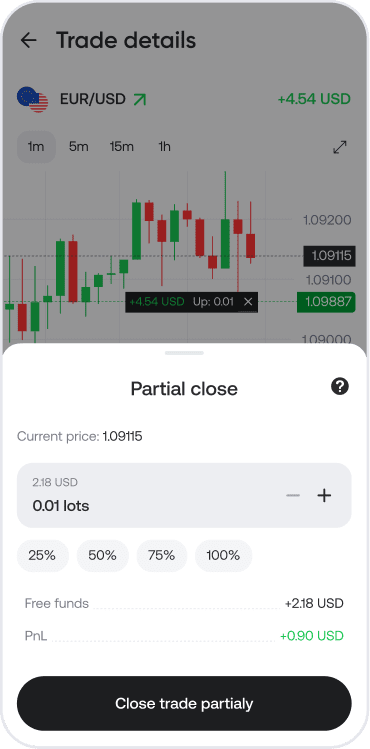

Partial close: Secure your profit without closing everything

Want to take some profit but keep the rest of the trade open? That’s what a partial close does!

- Go to Trade details

- Select your open trade

- Choose how much you want to close

- Hit Close trade partially — and keep the rest running!

🔐 That way, you secure your earnings while still leaving room for more profit.

-

Managing risks

Quick quiz: Test your knowledge

What’s a common strategy for setting both a stop loss and take profit?

-

Managing risks

Summing up

Awesome work! You’ve learned:

- How stop loss and take profit protect your trades

- How to set and adjust a SL and TP

- How to use partial close

You’re becoming a smarter trader! Next up: key insights into technical analysis. Let’s keep going!